Thankfully, we have made progress in changing the belief that health and wellness are personal matters and employers shouldn’t get involved. Given the amount of time that people spend at work, the workplace offers a valuable opportunity to promote healthy behaviours that improve employees’ overall wellbeing. When it comes to discussions of health and wellness in the workplace, however, financial health often isn’t top of mind.

That needs to change.

The 2017/2018 Global Benefits Attitudes Survey reports that 30% of employees believe that their financial concerns are negatively impacting their lives.1 Recent research indicates that 41% of Canadians rank money as their greatest sources of stress,2 44% are living paycheque to paycheque3, and 40% are overwhelmed by debt.3

Financial security is crucial to wellbeing and the stress associated with struggling to pay bills and take care of family responsibilities can negatively impact physical and mental health, which in turn can affect workplace productivity and performance.

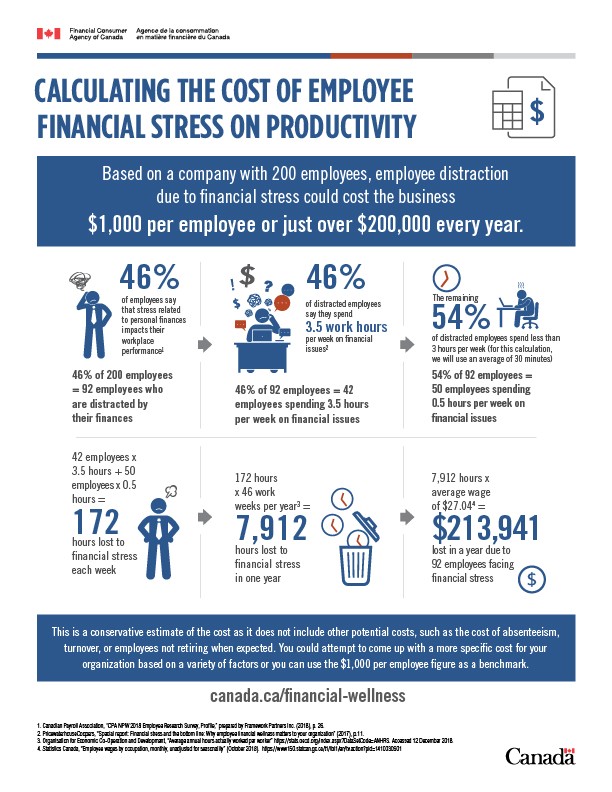

According to one study, financially stressed employees are 5 times more likely to be distracted at work and 46% spend at least three hours a week dealing with financial issues.5 The government of Canada estimates that distractions due to financial stress costs companies about $1000 per employee each year.4 Statistics like these make a solid business case for actively helping employees improve their financial wellbeing. So how do you create a program that supports your employees’ financial health?

Base the program on employee needs.

Like the other components of your wellness program, financial wellness initiatives should target the specific needs and interests of your employees. Take the time to assess employees to better understand details such as financial goals and biggest financial challenges and concerns. If you already have a financial wellness program in place, an employee needs assessment can help you understand what’s working and where improvements may be needed. With this insight, you can better determine what topics your program should include, how you can best deliver the information, and when initiatives should be offered.

Choose the right content.

The information you share must be relevant to employees and their specific concerns, financial situations, and level of financial knowledge. Educate employees on a variety of topics such as savings and investments, debt repayment, budgeting, insurance, mortgages, retirement and financial planning. Consider life events to include based on employee demographics and where they are in their lives and careers: starting a new job, buying a home, starting a family, getting ready to retire. The employee needs assessment will be helpful with this.

Make sure content is accessible.

Consider different learning styles and leverage various methods of communication including in-person workshops, online webinars, printed resources and digital tools. Incorporate onsite initiatives along with information and resources that they can use on their own time. Ensure initiatives and resources are available when employees need them. For instance, if they can’t attend a workshop, make sure they can still access the information later. Employees should know where to find resources to help them, so they can leverage them when they are ready and able. Half the battle is knowing where to go to find reliable information and people who are stressed about their financial situation are often so overwhelmed, they don’t know where to begin.

Leverage relationships.

Establish partnerships with third-party experts such as financial institutions and planners. Some may even facilitate workshops and lunch-and-learns free of charge. Take care to establish the right relationships, however. You want to ensure that the guidance and support they receive is in their best interest and you do not want your employees used as a sales channel for financial products and services. Connect with quality professionals and offer financial counselling as a support tool or ensure that employees know how to easily access one themselves. Working one-on-one, counsellors can personalize activities and target specific challenges and goals.

BONUS: Check out our interview with financial wellness expert, Steve Sztricsko . Want more? You can also find an interview with Ryan Van de Laar, another financial wellness expert, here: https://youtu.be/VHHXFnnkOoI!

Promote the program.

In order for your financial wellness program to accomplish what it’s intended to do, your employees need to know about it. Look for effective strategies to spread the word and keep employees engaged. Ensure that financial wellness is seen as part of your organization’s complete wellness program and not an unrelated – and less important – initiative. Look for opportunities to integrate financial wellness into existing programs and processes. For instance, include workshops as part of onboarding new employees or offer consultations to mid-career employees to ensure they are on track with retirement preparation.

You can leverage some of the same strategies that you use to promote physical and mental wellness and create individual or team challenges and provide incentives and rewards to recognize achievements. Don’t forget to share the impact the program has had in improving the financial lives of other employees. Success stories can help employees see themselves achieving similar results and, therefore, encourage them to participate.

Need some more assistance?

Get your FREE Corporate Wellness Membership 90-Day Starter Kit to get you started! Employee Wellness Solutions Network can help you create a healthier culture resulting in a more profitable and successful workplace. Our memberships give you access to services including corporate wellness specialists, trainers and health coaches to help you create the best strategy for your organization. To learn more about the memberships, visit Employee Wellness Solutions Network.

Sources:

1 2017 Global Benefits Attitudes Survey. Willis Towers Watson, 2017. file:///C:/Users/bianc/Downloads/2017-global-benefits-attitudes-survey.pdf.

2 Financial Stress, Financial Planning Standards Council 2018 Survey. http://fpsc.ca/docs/default-source/FPSC/news-publications/fpsc_financial-stress-survey.pdf.

5 Special report: Financial stress and the bottom line: Why employee financial wellness matters to your organization. PricewaterhouseCoopers, 2017. https://www.pwc.com/us/en/private-company-services/publications/assets/pwc-financial-stress-and-bottom-line.pdf

Leave A Comment